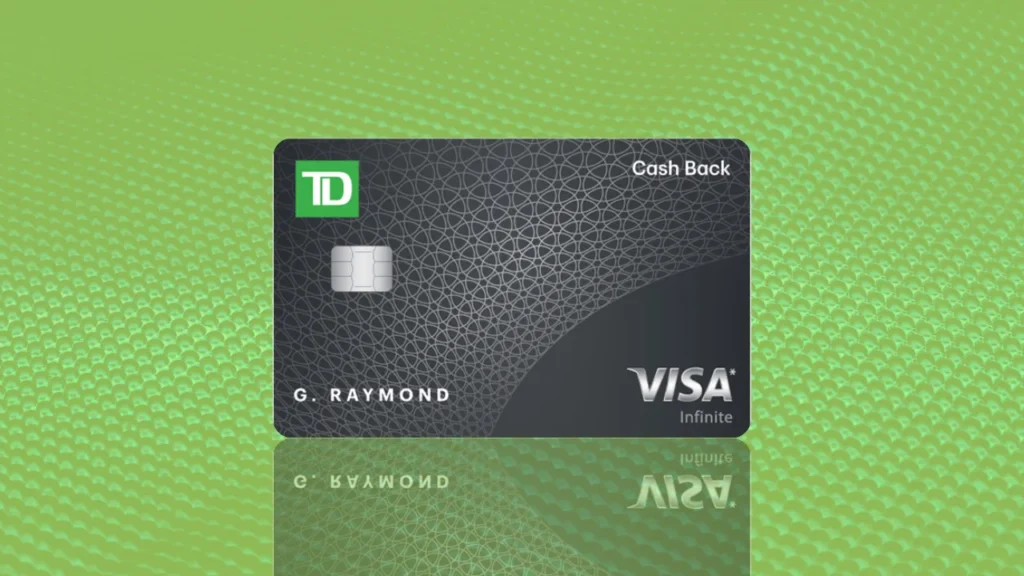

The TD Credit Card is an ideal choice for anyone looking to take control of their finances.

Whether you’re new to credit or a seasoned cardholder, this card offers a wealth of benefits that can improve your financial situation.

If you’ve already explored other options, you’ll find that the TD Credit Card stands out with its competitive interest rates.

By choosing this card, you’re not just making a purchase; you’re investing in smarter financial choices.

When it comes to smart spending, the TD Credit Card is designed to make your everyday purchases work harder for you.

With cashback rewards and Aeroplan points for travel, you get more value from each swipe.

In addition, the card comes with no annual fee, which makes it an even more accessible choice for anyone looking to save.

The rewards system is one of the key highlights.

Every time you use your TD Credit Card, you’re earning cashback or Aeroplan points that can be redeemed for travel or other exciting benefits.

This flexibility in rewards allows you to choose the benefits that best fit your lifestyle.

Whether you’re looking to save money, travel the world, or enjoy everyday purchases with added perks.

By choosing the TD Credit Card, you’re not just benefiting from rewards.

But also enjoying the convenience of low-interest rates and a streamlined user experience.

This credit card is a tool that can help you achieve your financial goals.

Maximize Your Chances of Approval for the TD Credit Card

If you’re wondering how to increase your chances of being approved for the TD Credit Card, follow these practical steps to ensure you have the best possible outcome.

- Check Your Credit Score: Ensure your credit score is within the range that TD typically approves for credit cards. A higher score increases your chances of approval.

- Ensure a Stable Income: TD looks for applicants with a steady source of income. Having a consistent job or reliable self-employment income can boost your approval odds.

- Review Your Debt-to-Income Ratio: Make sure your existing debt is manageable. A lower ratio improves your chances of approval.

- Ensure Accuracy on Your Application: Double-check all the information you provide. Inaccurate or incomplete details can delay or derail your application.

- Avoid Recent Credit Applications: Multiple recent credit applications can signal risk to lenders. Aim for a clean record when applying for new credit.

- Consider a Co-Applicant: If you’re new to credit or have a low score, adding a co-applicant with stronger credit can increase your approval chances.

How to Apply for the TD Credit Card

Applying for the TD Credit Card is a straightforward process.

Here’s a detailed breakdown of the steps involved to ensure you’re ready to submit your application with confidence.

- Review the Requirements

Before you start the application process, make sure you meet the basic eligibility requirements. You will typically need to be a resident of Canada or the U.S., depending on the card’s region, and meet the minimum age requirement. - Gather the Necessary Documentation

Ensure you have all the required documents ready. This may include proof of income, identification, and your social security number (or equivalent). Having this information on hand can speed up the process. - Choose the Right Card Option

TD offers different types of credit cards, each with varying benefits and rewards programs. Take the time to choose the card that best aligns with your spending habits and goals. - Complete the Application

You can apply online, over the phone, or at a TD branch. For the fastest process, it’s recommended to apply online through TD’s website, where you can fill out the necessary forms and submit them electronically. - Submit Your Application

After filling out the application, review it for accuracy, ensuring that all the information is correct. Submit the application for TD’s review. - Wait for Approval

TD will evaluate your application based on your credit score, income, and other factors. If approved, you will receive your card in the mail along with your credit limit details. - Activate Your Card

Once you receive your TD Credit Card, activate it as soon as possible. Follow the instructions provided by TD to activate your card and begin using it for your purchases. - Start Enjoying Your Benefits

Once your card is active, start enjoying the rewards, low interest rates, and no annual fees. Use your card wisely to take advantage of cashback rewards and Aeroplan points.

By clicking the button you will be redirected to another website.

Conclusion: Make the Most of Your TD Credit Card

The TD Credit Card offers a wealth of benefits for those looking to manage their finances better.

With no annual fee, low interest rates, and rewarding cashback, it’s a great option for anyone seeking a versatile and user-friendly card.

The added bonus of Aeroplan points ensures that your travel dreams are closer than ever.

Whether you’re aiming to build your credit or optimize your spending, this card helps you achieve your financial goals with ease.

Start making smarter financial decisions today by choosing the TD Credit Card. With a mix of flexibility, rewards, and simplicity, it’s more than just a credit card—it’s a step toward a brighter financial future.

Frequently Asked Questions

1. Does the TD Credit Card have an annual fee?

No, the TD Credit Card comes with no annual fee, making it a cost-effective option for cardholders.

2. Can I earn cashback with the TD Credit Card?

Yes, the TD Credit Card offers cashback on every purchase, helping you save more on everyday expenses.

3. How do I redeem Aeroplan points with the TD Credit Card?

Aeroplan points can be redeemed for flights, hotels, car rentals, and more, offering a wide range of travel options.

4. What are the interest rates on the TD Credit Card?

The TD Credit Card offers low interest rates, which can help you save money if you carry a balance.

5. Can I apply for the TD Credit Card online?

Yes, you can apply online through TD’s website for a quick and easy application process.

6. Is the TD Credit Card good for building credit?

Yes, the TD Credit Card is a great tool for building or improving your credit when used responsibly.

7. How can I check my credit limit with TD?

You can check your credit limit by logging into your TD account online or by calling customer service.

8. Are there any rewards for new cardholders?

Yes, new cardholders may be eligible for a sign-up bonus or introductory rewards, depending on the card offer.

9. Can I use the TD Credit Card internationally?

Yes, the TD Credit Card is widely accepted around the world, making it ideal for international travel.

10. How can I manage my TD Credit Card account?

You can manage your TD Credit Card account online or through the TD mobile app for convenience.

11. Can I transfer a balance to my TD Credit Card?

Yes, TD offers balance transfer options, allowing you to move your debt from other credit cards to your TD Credit Card.

12. What should I do if I lose my TD Credit Card?

Immediately contact TD customer service to report a lost or stolen card and request a replacement.

13. How do I activate my TD Credit Card?

Follow the activation instructions included with your card or activate it online through TD’s website.

14. What types of rewards can I earn with the TD Credit Card?

You can earn cashback on purchases or Aeroplan points for travel rewards, depending on the card type.

15. Does the TD Credit Card offer fraud protection?

Yes, the TD Credit Card includes fraud protection to help safeguard your transactions.

16. Can I add an authorized user to my TD Credit Card?

Yes, you can add an authorized user to your account, but keep in mind that you are responsible for the charges.

17. Are there any foreign transaction fees with the TD Credit Card?

Some TD Credit Cards charge a foreign transaction fee when used internationally. Be sure to check the card’s terms for specific details.

18. What is the credit limit for a TD Credit Card?

Your credit limit will depend on your creditworthiness, income, and other factors evaluated by TD.

19. How long does it take to receive my TD Credit Card?

Typically, you will receive your card within 7 to 10 business days after approval.

20. Can I upgrade my TD Credit Card to a different tier?

Yes, you may be eligible to upgrade your TD Credit Card to a different tier depending on your spending habits and credit history.