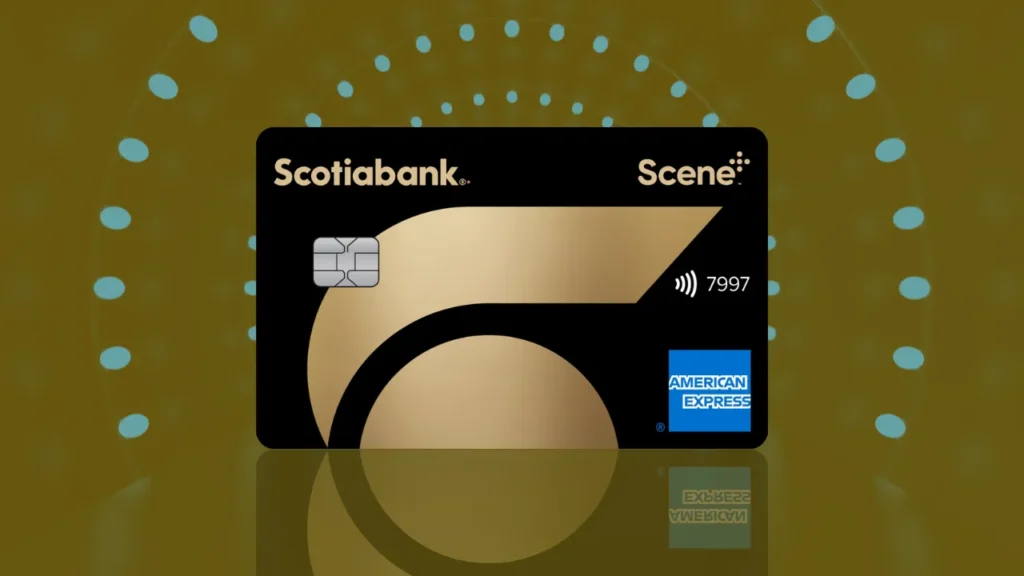

The Scotiabank Card is more than just a credit card

It’s a financial upgrade that redefines how you manage everyday spending.

In today’s fast-paced world, finding a card that offers real value without hidden fees feels like a rare discovery.

That’s why understanding its benefits can make all the difference.

Imagine earning points on your morning coffee, weekly groceries, or travel bookings.

It’s more than convenient—it’s empowering.

Every transaction can bring you closer to financial rewards that align with your goals.

No need to stress over annual fees.

Instead, your focus can shift to maximizing perks that improve your lifestyle.

With no extra costs, the value of each benefit becomes clearer.

Tracking your rewards should be simple, and Scotiabank’s streamlined platform ensures transparency.

You can monitor points, track spending, and explore exclusive offers with ease.

This card adapts to your needs, whether you’re a frequent traveler, a small business owner, or someone building credit.

It’s a tool designed to enhance your financial decisions.

Think of it as a card that rewards you for simply living your life.

From cashback to bonus categories, every feature is built to help you get more from your daily expenses.

Are you trying to boost your financial health?

Consistent use of this card can strengthen your credit history and open doors to better financial opportunities.

Safety and security matter too.

With zero-liability protection, you can shop with confidence knowing your purchases are protected.

For budget-conscious users, the low-interest rates make it easier to handle larger expenses without accumulating unnecessary debt.

Even digital payments feel seamless with this card, thanks to its compatibility with major mobile wallets.

Financial freedom is about making smarter choices, and this card supports those decisions with every swipe.

It’s not just about spending—it’s about earning while you spend.

This simple concept can reshape how you approach your monthly expenses.

Picture yourself redeeming rewards for something meaningful, whether it’s a vacation, a special purchase, or cashback that supports your budget.

Why settle for basic rewards when you can enjoy a program that offers flexibility and real value?

This guide will walk you through how to increase your approval chances and make the most of your Scotiabank Card.

Let’s explore every detail and ensure you make an informed decision.

Ways To Increase Your Approval Chances

Getting approved for the Scotiabank Card involves more than filling out an application.

Here’s how you can improve your chances:

- Maintain your credit utilization below 30% to show responsible usage

- Pay bills consistently and avoid late payments to strengthen your credit score

- Review your credit report for errors and dispute inaccuracies to keep your report clean

- Reduce outstanding debts to improve your debt-to-income ratio

- Avoid applying for multiple credit cards at once, as this can lower your credit score temporarily

- Ensure that your income and employment information is accurate and stable

- Consider using pre-qualification tools to gauge your eligibility without impacting your credit score

By following these steps, you’ll present a strong financial profile and increase the likelihood of approval.

Everything You Need To Know About The Application Process

Applying for a Scotiabank Card doesn’t have to be overwhelming.

Let’s break down the steps so you can navigate it smoothly.

Before Applying

- Check if you meet the basic eligibility criteria, such as age and residency requirements

- Gather required documents like proof of income, government ID, and recent utility bills

Choosing The Right Card

- Review different Scotiabank Card options to find one that aligns with your financial goals

- Whether you’re seeking cashback, travel points, or low-interest rates, choose a card that suits your lifestyle

Filling Out The Application

- Provide accurate personal information, including your full name, address, and contact details

- Include employment information to demonstrate your financial stability

- Report your income to help determine the credit limit you may receive

Final Review And Submission

- Double-check the application for any mistakes to prevent delays

- Submit the completed form online or visit a local branch if you prefer an in-person experience

What Happens After Submission

- Scotiabank will review your credit score, income, and overall financial health

- You’ll receive an approval decision, typically within a few business days

- If approved, you’ll receive your card with instructions for activation

Post-Approval Essentials

- Activate your card as soon as it arrives using the mobile app or customer service hotline

- Set up automatic bill payments to maximize rewards points and avoid late fees

- Download the Scotiabank app for real-time tracking of your spending and rewards

Understanding these steps makes the application process straightforward, ensuring you can start enjoying the card’s benefits sooner.

By clicking the button you will be redirected to another website.

Conclusion

The Scotiabank Card is more than a financial tool—it’s a lifestyle enhancer.

Whether you’re earning points on everyday purchases or benefiting from low-interest rates, it’s designed to add value to your financial decisions.

By taking advantage of its features, from zero annual fees to bonus categories, you can elevate your financial planning.

This isn’t just about convenience—it’s about empowerment.

Why wait to experience the rewards?

With the Scotiabank Card, every purchase becomes an opportunity to enhance your financial journey.

Frequently Asked Questions

What Can I Earn With The Scotiabank Card?

You can earn cashback, travel points, merchandise rewards, and more depending on your chosen card.

How Does The Card’s Cashback Program Work?

Cashback is calculated as a percentage of your eligible purchases and can be redeemed as statement credits.

Is There A Pre-Qualification Option Available?

Yes, you can check if you pre-qualify without impacting your credit score.

Does The Card Offer Fraud Protection?

Yes, the card includes zero-liability protection and real-time fraud monitoring.

What Is The Interest Rate On This Card?

The Scotiabank Card offers competitive low-interest rates for purchases and balance transfers.

Can I Add Another User To My Account?

Yes, you can add authorized users and even set spending limits for them.

Are There Any Travel-Related Benefits?

Yes, you can use points for travel expenses like flights, hotels, and car rentals.

Is There A Cap On Points I Can Earn?

No, there’s no limit on the number of points you can accumulate.

Is The Card Compatible With Digital Payment Apps?

Yes, the card works with digital wallets such as Apple Pay and Google Pay.

How Do I Maximize My Bonus Points?

Use the card for purchases in high-reward categories and during promotional periods.

Does The Card Support Balance Transfers?

Yes, there are options for balance transfers with competitive rates.

Are Foreign Transactions Charged A Fee?

Some cards may waive foreign transaction fees—check your specific card’s terms.

How Long Does The Approval Process Take?

Most approvals are processed within a few business days, though some cases may take longer.

Can I Request A Card Upgrade Later?

Yes, you can request an upgrade if your financial profile qualifies you for a higher-tier card.

Is Automatic Redemption Available For Points?

No, you can choose when and how to redeem your points manually.

Does The Card Help Build Credit?

Yes, regular use and timely payments can help improve your credit score over time.

Can I Earn Rewards On Subscription Payments?

Yes, you can earn points or cashback for recurring payments like streaming services and utilities.

What Happens If I Miss A Payment?

Missing a payment may result in fees and could affect your credit score, so staying on track is important.

Can I Track My Points In Real Time?

Yes, the Scotiabank app lets you monitor your rewards balance and spending activity.

Is There A Minimum Credit Score Required?

While no specific score is disclosed, having a strong credit history improves your chances of approval.